3 Tips To Boost Your Homes Online Appeal

Displaying blog entries 281-288 of 288

Unfortunately, selling your Chester County PA home in the current real estate market can be both difficult and frustrating. As much value as you may feel your home has, the current conditions might say differently. In this buyer’s market, accurate pricing of your home is imperative in getting your property sold quickly and for the best price possible. While this might sound simple enough, correctly pricing your property is far from easy and is a decision which requires time and effort on your part. The following tips should help make the pricing process a smooth and beneficial one for you.

Do your research: It’s important to know what other homes in your area are selling for right now in order to get an idea of a price point for your own property, but you shouldn’t rely on that alone. An Automated Valuation Model, better known as an AVM, is a web-based technology that immediately generates home values based on data analysis of recent area comparable sales, tax assessments and price trends. Click here for free sites.

Do your research: It’s important to know what other homes in your area are selling for right now in order to get an idea of a price point for your own property, but you shouldn’t rely on that alone. An Automated Valuation Model, better known as an AVM, is a web-based technology that immediately generates home values based on data analysis of recent area comparable sales, tax assessments and price trends. Click here for free sites.In December of 2007, Congress signed into law the Mortgage Debt Relief Act to aid distressed homeowners. Under regular circumstances, when a lender chooses to forgive all or part of a borrower’s debt, that amount is considered income and the borrower is liable to be taxed on it. However, this law offers relief to the owner of Chester County PA real estate in that debts discharged through calendar year 2012 are not taxable. Limited to primary residences only, the amount of forgiven mortgage debt allowed to be excluded from income tax is $2 million per year. Debts reduced through mortgage restructuring as well as mortgage debts forgiven in connection with foreclosure qualify for this relief.

On the fence about selling your underwater Chester County PA real estate as a short sale? Consider this: if your home isn’t sold before January 1, 2013, and you owe $50,000 more than its market value, you could realistically end up paying more than $12,000 in taxes in 2013 if you’re in the 25% tax bracket! Once you decide on going the short sale or foreclosure route—and remember, short sales often take a long time to sell--the first thing you need to do is to request that your lender officially and in writing waive any deficiency connected with your Chester County PA real estate. If this waiver is not granted, the lender has 20 years to obtain repayment from you via collection agencies, garnishments, and/or liens.

Because of the impending deadline and the length of time required for short sales and foreclosures, many real estate and financial gurus stress the importance of acting now to set wheels in motions. They urge distressed owners of Chester County PA real estate to realize that there is no tax exclusion allowed on pending closings/foreclosures. Only transactions completed by December 31, 2012, are eligible for income tax relief—and there are no indications that the current deadline will be extended!

When the Obama administration announced the Home Affordable Modification Program (HAMP) in 2009, officials estimated 3 to 4 million borrowers would seek relief from their mortgages through the program during the worst recession and housing market collapse in decades. More than two years later, however, those projections have proven to be optimistic, to say the least. Mired in extensive paperwork, lost documentation, costly time delays, and extreme frustration on the part of the Chester County PA home owners attempting to participate, the program has been examined, monitored, revised over and over to make the process a smoother and more successful one. A daunting task, however; the most recent report by the Office of the Special Inspector General for the Troubled Asset Relief Program SIGTARP) devoted over 15 pages to a description of procedures, requirement, and changes involved with the program!

Originally designed to help financially struggling owners of Chester County PA homes avoid foreclosure by modifying their loans to a level that is both affordable and sustainable, HAMP’s success is uncertain—or at least arguable. Critics charge that only 700,000 owners have actually benefitted from the program and claim that while the Treasury initially committed $75 billion of Troubled Asset Relief Program funds to the HAMP initiative, it now appears it will spend only $4 billion on HAMP incentives.

The members of the Congressional Oversight Panel even stated that government’s loan modification program was “ineffective,” and they claimed that the Treasury’s reluctance to address flaws of the program has had “real consequences.” Their report also states that the Treasury has failed to hold loan servicers accountable when they have repeatedly lost borrower paperwork or refused to perform loan modifications. And TARP has stated “The program has been beset by problems from the outset and, despite frequent retooling, continues to fall dramatically short of any meaningful standard of success."

There are, of course, success stories, and supporters point out that the 700,000 approved loan modifications mean that many fewer foreclosures. They urge financially-strapped home owners to fully investigate the program, get help to complete the sometimes grueling process, and use websites specifically designed for the potential applicant. They also maintain that eligible homeowners entering HAMP have a high likelihood of earning a permanent modification and realizing long-term success. The rate of modifications moving from trial to permanent is up to 74 percent, and the average time to convert from a trial to permanent modification is down to 3.5 months.

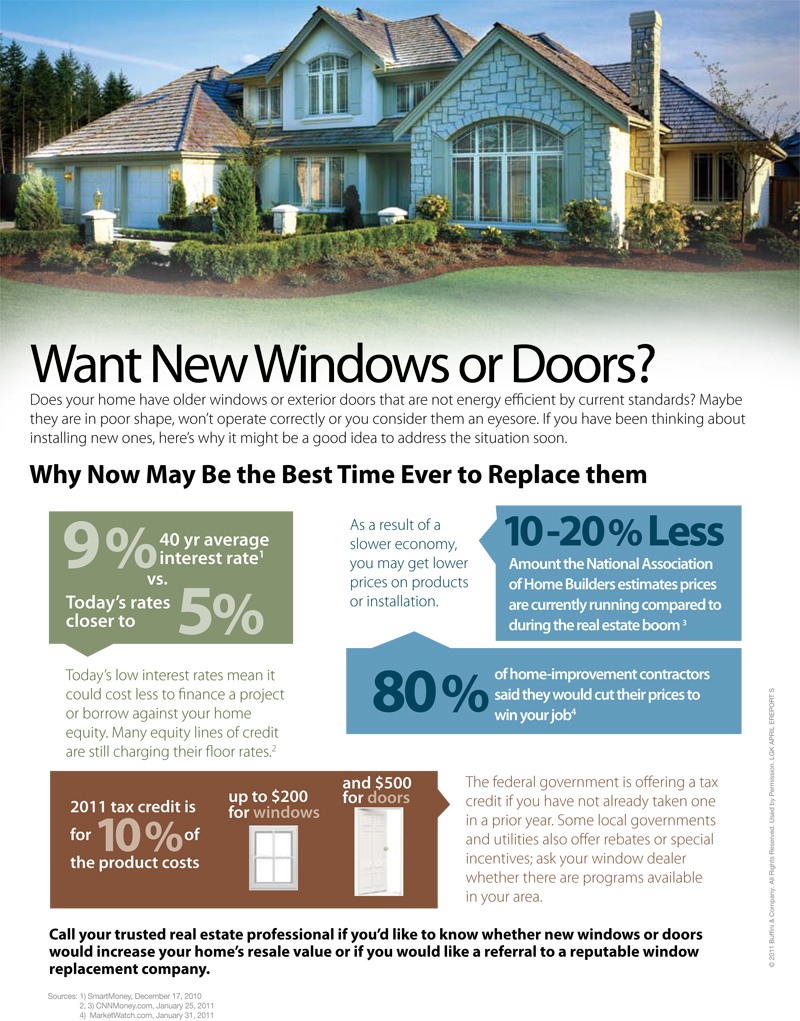

Want New Windows and Doors For Your Chester County PA Real Estate?

For the latest Chester County PA real estate market conditions in your neighborhood, please call me at 610-564-SCOT or visit ChesterCountyHomeSource.com.

Sweep out the dust bunnies. Clear away the clutter. Time to put wasted space beneath the staircase to work with customized storage solutions. Read

Visit houselogic.com for more articles like this.

Copyright 2011 NATIONAL ASSOCIATION OF REALTORS®

Scott Darling Earns Prestigious Designation to Help

Homeowners in Danger of Foreclosure

Scott Darling of RE/MAX Action Associates in Exton, PA has earned the prestigious Certified Distressed Property Expert® (CDPE) designation, having completed extensive training in foreclosure avoidance, with a particular emphasis on short sales. At a time when millions of homeowners are struggling with the possibility of foreclosure, the skills and education accumulated by Darling will help benefit Chester County area  residents and communities.

residents and communities.

Short sales allow the distressed homeowner to repay the mortgage at the price that the home sells for, even if it is lower than what is owed on the property. With plummeting property values, this can save many people from foreclosure and even bankruptcy. More and more lenders are willing to consider short sales because they are much less costly than foreclosures.

Today, more than 13 percent of homeowners are delinquent on their mortgage or in the foreclosure process. This is occurring across all price ranges, and the fastest-growing category of homes in foreclosure is the luxury home market.

“The CDPE designation has been invaluable as I work with homeowners and lenders on complicated short sales,” said Darling. “It is so rewarding to be able to help families save their homes from foreclosure.”

Alex Charfen, co-founder and CEO of the Distressed Property Institute in Austin, Texas, said that agents such as Darling with the CDPE Designation have valuable perspective on the market, and training in short sales that can offer homeowners real alternatives to foreclosure, which can be devastating to credit ratings.

“These experts better understand market conditions than the average agent, and can help sellers through the complications of foreclosure avoidance,” he said.

The Distressed Property Institute provides live and online courses to train real estate professionals how to help homeowners in distress, with a particular emphasis on handling short sales.

“Our goal is to help as many homeowners as possible, by educating as many real estate professionals as possible,” Charfen said. “Darling has demonstrated a commitment to the struggling homeowners, and will provide much-needed assistance in stabilizing the community.”

Are you or someone you know behind on mortgage payments? Don't delay! Contact Scott for a personal consultation. He may be able to help you save your home and your family!

Displaying blog entries 281-288 of 288