Six Tips on Building Equity in Your Home

What is home equity? The Balance explains it this way: home equity “...is the amount that you own, or what you would get after paying off your mortgage after selling.” For most Americans, their home is their largest investment, so keeping a watchful eye on the equity and taking action when it is necessary is their first defense.

-

Before purchasing a new home, consider adding more to the down payment. This simple action creates equity by reducing the amount of your mortgage loan.

-

The smaller the loan term, the faster the loan is paid off. Your payments will be higher, but if it is affordable, it is a fantastic way to gain equity quickly.

-

Every monthly payment you pay towards your mortgage automatically builds equity unless your mortgage is an interest-only loan. Discuss this with your lender before you begin because you want to be certain that you are paying down the principal.

-

- Adding to your payment each month not only builds the equity, but it will save money on interest in the long-term.

-

- Consider dividing your monthly payment into two payments every other week. This is This plan makes it easier for you to squeeze in one extra payment per year. (26 half-payments=13 monthly payments)

-

- Less expensive ways to pay the principal down sooner: round up your monthly payment, budget a smaller amount each month to be paid on your loan, or use a tax refund or work bonuses to pay towards the principal.

-

Properly maintaining your home will at least keep up the value, depending on the market, of course. Roof leaking? Repair it. Paint peeling? Grab a paintbrush. Sweat equity does not cost you anything, but if you must, hire a pro so that the job is done right.

-

Adding value to your home is possible, but only if you are not spending too much out-of-pocket or dipping into a home equity loan to make the upgrades.

-

Refinance your mortgage only if it is necessary or if you are decreasing the loan term.

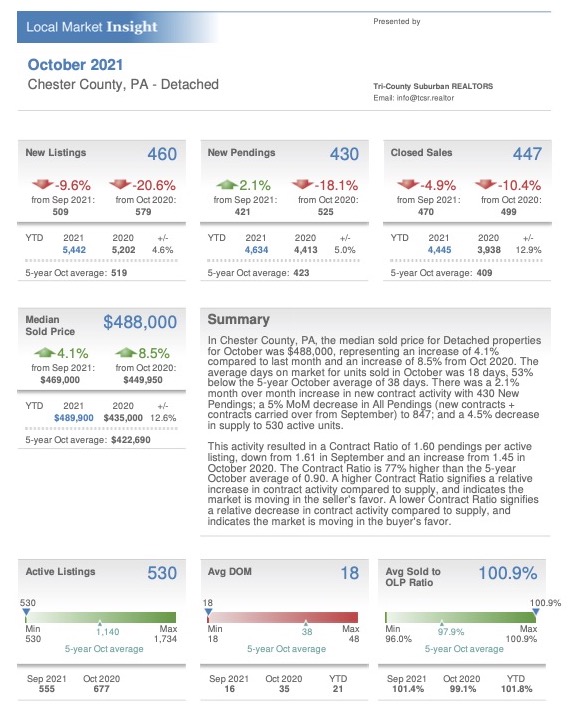

If you are unsure about the local market, call me and ask me to pull recent sales in your neighborhood so you can compare selling prices of similar homes with your mortgage balance. Now may be a good time to sell if you have enough equity in your home, and I will help you every step of the way!

Courtesy of Chester County PA Realtor Scott Darling.

Photo credit: Forbes