5 Home-Improvement Projects to Help Sell Your Home

he real estate market has improved across much of the country, but homeowners thinking about listing their homes this summer need to stay competitive to attract buyers. Buyers are looking for long-term homes, ones they want to stay in for years while raising their children, or settling down and retiring.

To prepare your home for listing - or simply to enjoy it a few years longer - check out these top five home improvement projects you can do yourself to make your home more attractive to buyers:

To prepare your home for listing - or simply to enjoy it a few years longer - check out these top five home improvement projects you can do yourself to make your home more attractive to buyers:

1. Give the front door a new look - The front door sets the tone for your home's curb appeal and security, and it signals how well you maintain everything else. Buyers will be walking into your home via the front door, so be sure to give them a good first impression. If your door is in good shape, you might just need to give it a refreshing new coat of paint or new hardware. But if it's seen some wear and tear over the years, consider replacing it with a steel door - one that will show buyers your home is safe.

2. Update the most-used entryway - While the front door needs curb appeal, the garage door is traditionally the most-used door in the home. Old wooden garage doors will start to sag and the paint will peel, giving your home a run-down look. Replacing this door with an insulated steel door will not only improve the exterior look of your home, but also keep the garage space warmer. Finishing off the garage can also be a big draw for buyers, but you probably won't be able to recoup as much of the expense as you would by replacing only the garage door.

3. Add additional living space - You might not think about adding a deck as the same thing as adding an extra room to the house, but if you're selling your home during the warmer months, that's how buyers will see it. They'll be able to picture themselves enjoying breakfast and picnic dinners outside, or curling up on a lounge chair with a good book on a summer afternoon. Realtor.com estimates that homeowners can recoup 87 percent of the investment of adding a deck when they sell.

4. Create a bathroom retreat - As the smallest room in the house, the bathroom tends to cost the least to remodel. If you have a guest or master bath that can use a little help to transform into a relaxing oasis, take the opportunity to replace the flooring, add cushy rugs, paint the walls and replace the accessories with more modern styles. Faucets, showerheads, the mirror and even the toilet can all be upgraded with water-saving and stylish designs. Buyers will take note of a maintenance-free bath, making your home one they'll remember as move-in ready.

5. Turn the backyard into a private paradise - Buyers will be visualizing themselves in your backyard when touring your home. They're looking to see how quiet and secure the space is. Consider adding a beautiful wooden fence to enhance the privacy. It will make the home attractive to families with children and pets, and for couples who aren't interested in having a conversation with the neighbors every time they go outside. (BPT)

Mow your grass before you leave for your vacation. I would suggest that you set the mower on the shortest cut you can get so that you don’t have to worry about it growing up while you are gone. If you are going to be gone for an extended period of time you may want to arrange to have a family member mow your yard at least once while you are gone. Mowing your yard before vacation makes it look like you are still at home and therefore may keep away potential intruders.

Mow your grass before you leave for your vacation. I would suggest that you set the mower on the shortest cut you can get so that you don’t have to worry about it growing up while you are gone. If you are going to be gone for an extended period of time you may want to arrange to have a family member mow your yard at least once while you are gone. Mowing your yard before vacation makes it look like you are still at home and therefore may keep away potential intruders.  According to

According to  Reasons not to downsize:

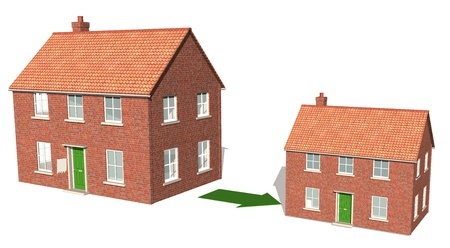

Reasons not to downsize: .jpg) The value of home improvements has two primary considerations:

The value of home improvements has two primary considerations: better match for financing a wedding. The key is to research the various types of loans, know what services they're designed to provide and then choose the one that best fits your financial needs.

better match for financing a wedding. The key is to research the various types of loans, know what services they're designed to provide and then choose the one that best fits your financial needs. it, and how you give it the water it needs. Here are some water-conservation tips for growing a garden and using the least amount of water possible:

it, and how you give it the water it needs. Here are some water-conservation tips for growing a garden and using the least amount of water possible: 1. What are my financial goals?

1. What are my financial goals? In the case of a couple having a joint mortgage, the death of one spouse will simply mean the other spouse becomes the sole mortgage-holder. As long as she can continue making the payments, the property will be unaffected. Federal law prohibits the lender from calling the entire mortgage due because one spouse has passed away.

In the case of a couple having a joint mortgage, the death of one spouse will simply mean the other spouse becomes the sole mortgage-holder. As long as she can continue making the payments, the property will be unaffected. Federal law prohibits the lender from calling the entire mortgage due because one spouse has passed away.  Here’s a summary of some thoughts from

Here’s a summary of some thoughts from