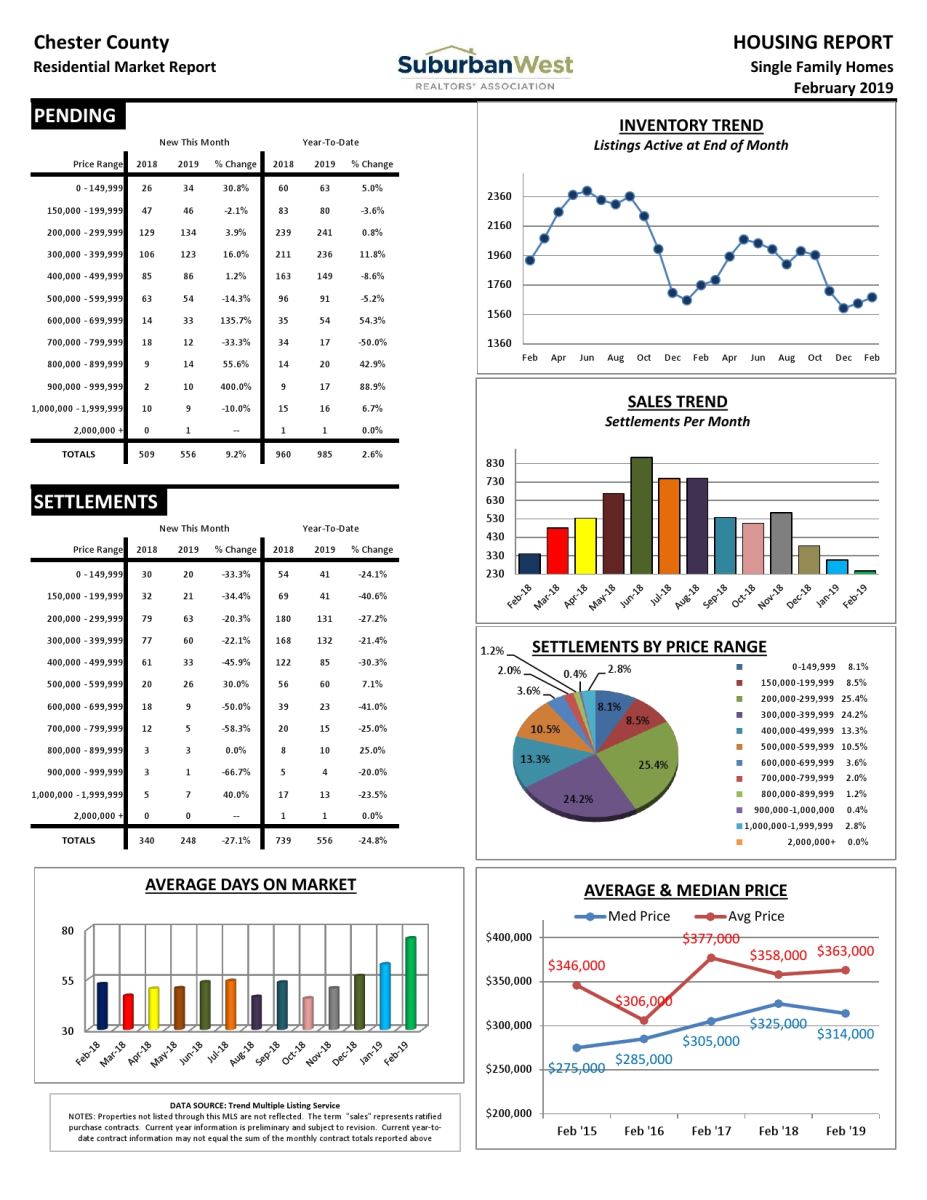

Chester County PA Real Estate Market Trends for February 2019

Chester County PA Real Estate Market Trends for February 2019

Chester County PA single-family homes saw pending sales increase by 9.2% in February 2019 when compared to February 2018. 248 homes sold in February with a median sales price of $314,000. The average sales price increased by 1.4%, and homes were on the market 20 days more.

If you are thinking about selling your home get a free instant home evaluation Learn More.