In-Law Suites

For many families in the United States, it has become the norm for more than two generations to live under one roof as aging parents move in with their adult children. Not every house has the extra room, nor do mostly independent seniors care to downsize and live in one room with a half bath. While there are a few different solutions to the issue, there are many things to consider.

-

-

First and foremost, questions need to be answered: Is it possible to sell both homes and purchase one larger one? Are the in-laws simply wanting two rooms and a bathroom to themselves? Will the older parents sell their home and pay for an in-law suite to be built onto their adult children’s home?

-

Another solution could be that the older generation has the largest house, and the younger family could relocate. Again, everyone needs to be put into consideration, as this could uproot school-aged children, and even take the working adults further away from their jobs.

-

If a new house hunt begins, look for houses that have the potential to create a small apartment in the existing rooms, or have space to add an in-law suite. Another option is a duplex, so parents that are still independent can keep their own house, but have the family just a few steps away, just in case.

-

Building an addition onto any home requires some investigation to make certain your municipality will allow it, as it will almost be a separate dwelling.

-

Some of the needs and wants in an in-law suite include:

-

- separate entry/locked entry from “other” dwelling

-

- first-floor accommodations

-

- full bathroom

-

- kitchen essentials, as zoning codes allow

-

- sitting room separate from sleeping area

-

- wide doorways, no-slip flooring, handrails in appropriate areas

-

A garage, underused attic, or basement can be easily converted to a small apartment-like dwelling. Just make sure there is adequate natural lighting, as all of these can be dark spaces. Where lots of windows are not an option, adding skylights take care of letting some sunshine in.

-

One more option is building a cottage-type building on the property, as regulations allow.

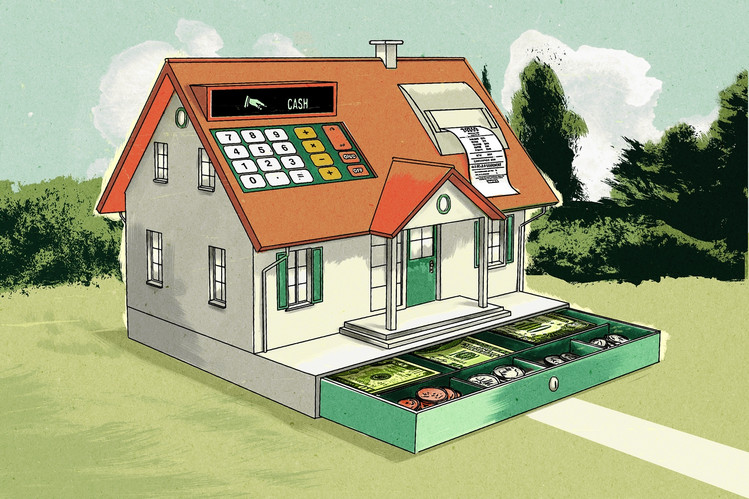

While finances are likely the number one factor for making the major decisions, family dynamics are another factor in this new living situation. Every family is different, and while some want their privacy and ask others to knock before coming into their “house,” some families will have an open-door policy, sharing meals and housework equally, and have their own little commune. No matter what the accommodations will be, communication is key to making certain a multi-generational home is for the best, as well as successful.

Courtesy of Chester County PA Realtor Scott Darling.

Photo credit: Cornerstone, NE Calgary